"The Art and Science of market forecasting"

Amazing Accuracy In Market Timing

"Time Is More Important Than Price."

“At AmazingAccuracy.com, we understand that timing is everything in the world of futures and forex trading. Knowing when to expect a market top or bottom can be the key to minimizing risk exposure and maximizing profit potential.

That’s why we developed our proprietary FDates (future turn dates) that allow traders to predict with a high probability of accuracy when the market will turn. While nothing is 100% accurate, using FDates to time the market can give traders a significant edge in market timing.

By subscribing to our service, traders can receive our FDate turn dates every week which can help them make more informed trading decisions. With a precision of within one trading day, our FDates can give you a significant advantage in predicting market bottoms and tops.

Welcome to the Edge of Market Timing

Markets move in cycles—knowing when these cycles are likely to turn can mean the difference between following the crowd and leading it. At AmazingAccuracy.com, we provide traders like you with the FDate Report, a unique approach to market timing based on precise cycle turn dates. Developed through proprietary algorithms, our FDate Report helps you anticipate market pivots on daily and weekly timeframes, allowing you to prepare for potential swings rather than reacting after the fact.

Why Market Timing Matters

In a fast-paced market, being even one step ahead can significantly impact trading decisions. By leveraging market cycles, the FDate Report sheds light on critical moments where price direction may change, pinpointing potential pivot points with a level of accuracy that could sharpen your timing and refine your strategy.

Cycle Turn Dates: Insight, Not Guarantees

We understand that timing the market is a controversial concept—absolute accuracy is unattainable in such a complex environment. However, our cycle turn dates, while not infallible, have demonstrated consistent reliability in identifying potential swings within a narrow window. Each week, the FDate Report provides:

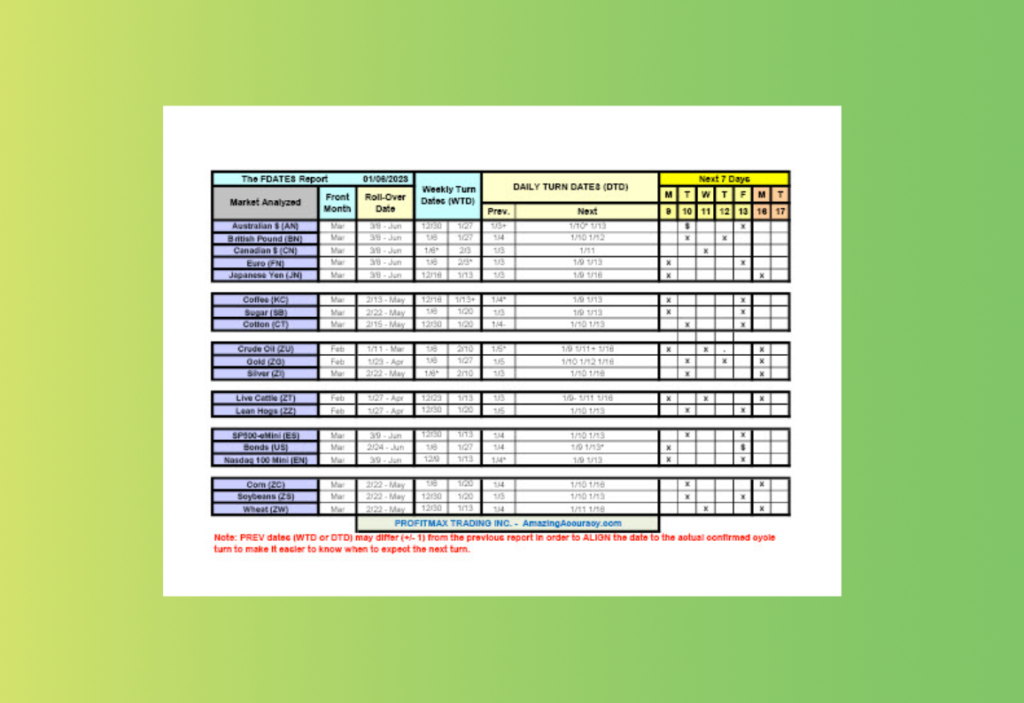

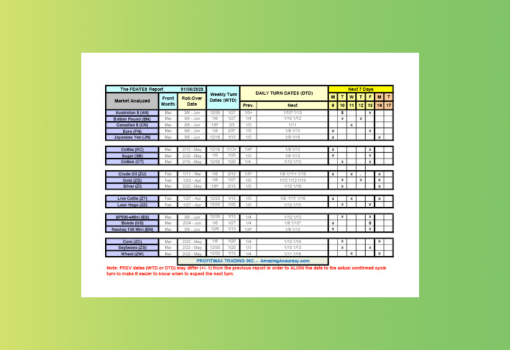

- Daily Cycle Dates – Short-term pivot days where price reversals are expected, typically accurate to within +/- one day.

- Weekly Cycle Dates – Longer-term cycles that reveal potential trend changes on the weekly chart, within +/- one weekly bar.

An Advantage That’s Meant to Inform, Not Predict

Our goal is simple: to inform, empower, and help you make informed decisions. We offer no promises, no guarantees of profits—only a tool that gives you valuable insight into when markets are likely to pivot, based on historically tested cycles.

Join the FDate Membership and Discover the Power of Preparation

If you’re ready to see the markets through a different lens, one based on timing and preparation, the FDate Membership could be the added edge you need. Equip yourself with advanced knowledge and approach the markets with the confidence of a trader who’s ahead of the crowd.

Explore Your Edge with the FDate Report Today.

The Fdate Report

Cycle Envelope Charts

Click Here to JOIN!

Join to receive our weekly FDate Report

Market Forecasting Secrets Book

A RARE Collection of 12 Amazing and PowerfulMarket Forecasting Techniques (No membership required to purchase)

Contact Us

Got More Questions? Email Me!

Frequently Asked Questions

DTDs and WTDs are the dates listed on our weekly posted FDate Report. These FDate turn dates are generated using our suite of proprietary applications (called the FDate Suite of Applications) that apply Geometric Mathematics and Cycle Extraction Protocols to historical price data in order to extrapolate into the near future the dates when the market is most likely to reverse (change direction). The DTDs are for the DAILY time frame charts and the WTDs for the WEEKLY time frame charts.

Due to the high accuracy of FDates in determining the dates when to expect a swing top or bottom to occur (+/- 1 price bar), we always expect a turn will occur for an upcoming FDate. As to knowing in advance whether that turn will be a bottom or top, there is no way to know for sure other than to note the direction of prices as we enter into that FDate time period. For example, if prices are moving higher into the FDate, naturally we would be expecting a swing top for that FDate. If prices making a new low into the FDate, we would expect a swing bottom will be forming.

Access to our FDates Market Forecasting membership site. Within this site, you gain access to our weekly FDate Report, updated weekly. The FDate Report contains both weekly and daily turn dates for the markets we cover. You have access to our training videos and tutorials, our Cycle Envelope charts, and the Previsions Charting application that provides powerful tools to use along with the turn dates.